December 2019

14th Edition | Issued 6th January 2020

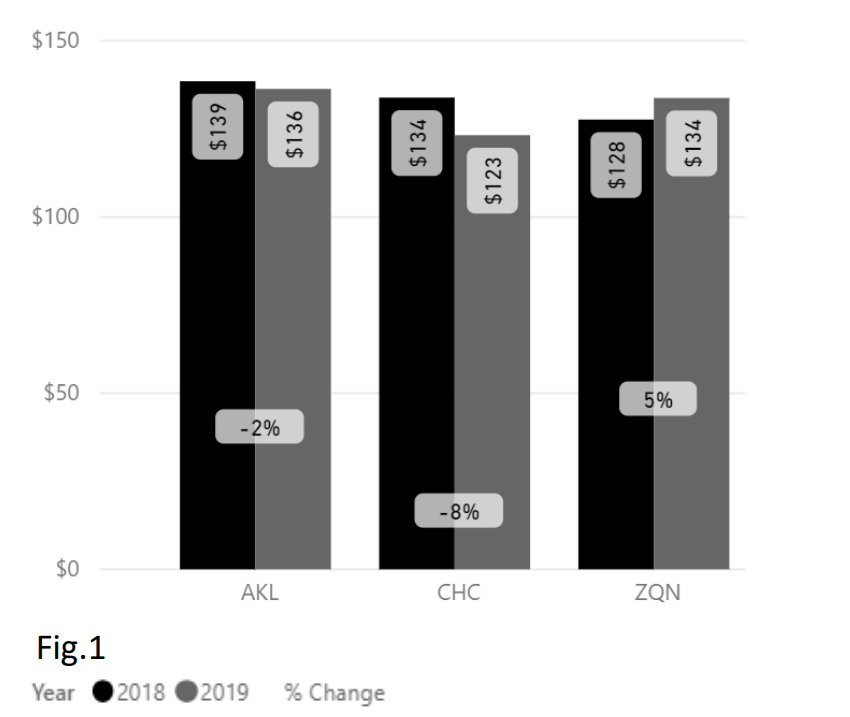

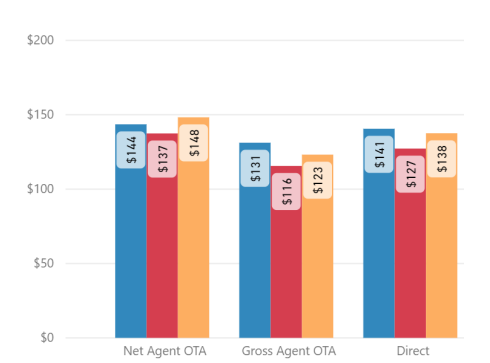

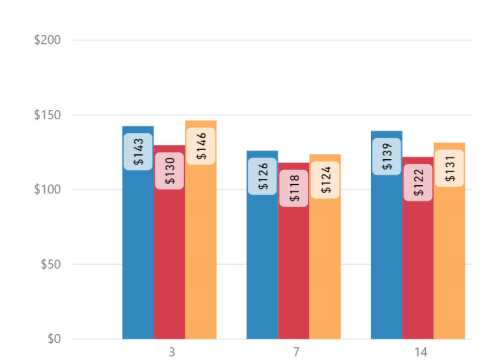

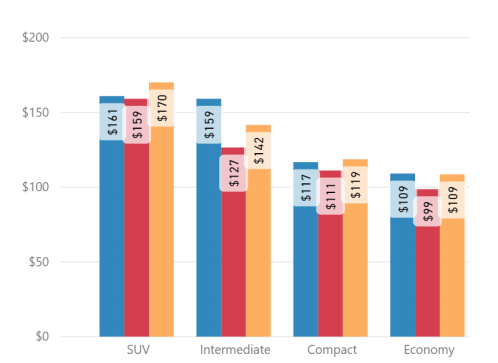

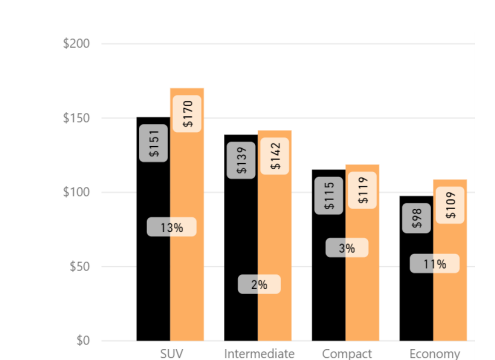

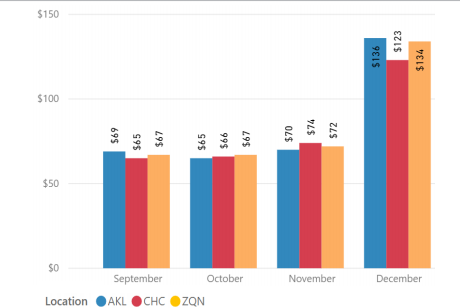

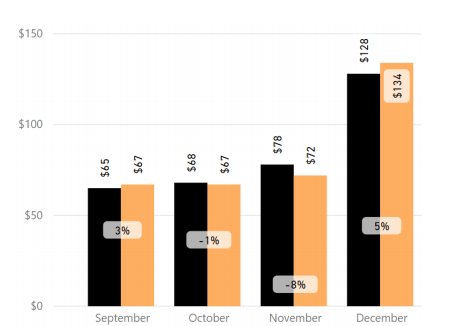

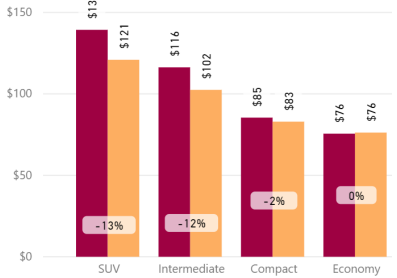

Refer to sales channels (Fig.2), duration (Fig.3) and vehicle category (Fig.4) graphs for the average rates during the month. Due to the peak season, the average for all durations and all vehicle categories increased, with the average rates for the SUV class almost doubling from November 2019.

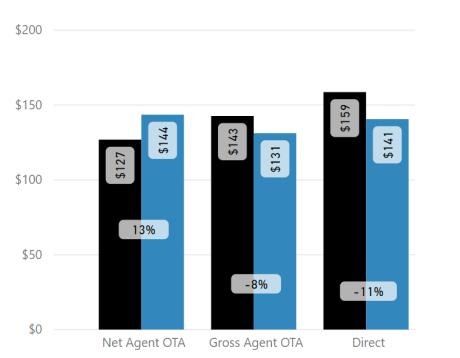

Fig. 2

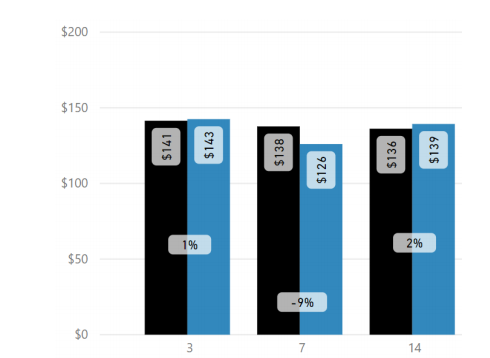

Fig. 3

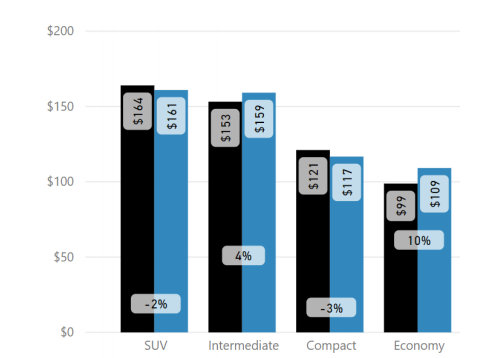

Fig. 4

Overall Auckland Airport had a YoY average rate decrease of -2%.

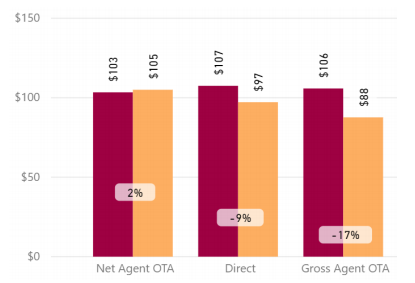

The Net Agent OTA sales channel average rate was +13% higher, while the Gross Agent OTA and the Direct sales channels showed decreases of -8% and -11% respectively (Fig. 5).

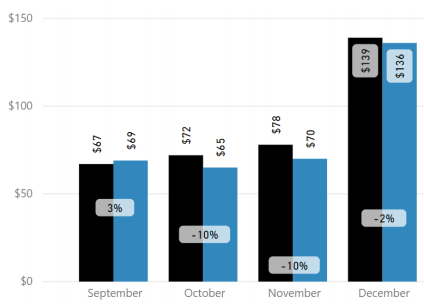

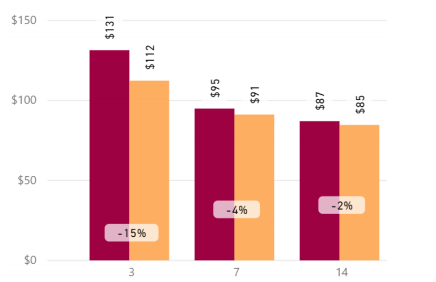

The average rate for 3-day duration increased +1%, while the average rate for 7-day duration was -9%, and 14-day duration +2% (Fig. 6).

The average rate for SUVs in Auckland was -2% YoY, all other categories showed average rates of between +10% and -3% (Fig. 7).

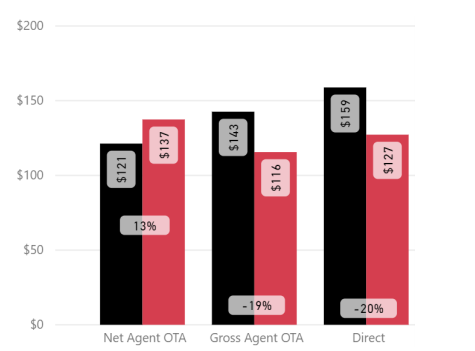

Fig. 5

Fig. 6

Fig. 7

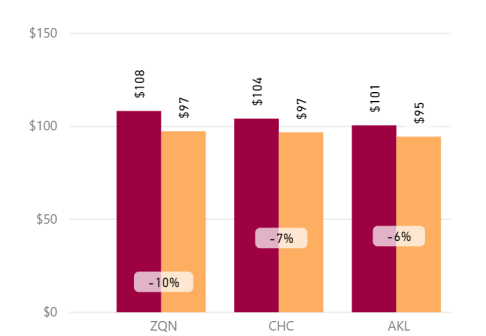

Overall Christchurch Airport had a YoY average rate decrease of -8%.

The Net Agent OTA sales channel average rate was +13%, while the Gross Agent OTA and the Direct sales channels showed decreases of -19% and -20% respectively (Fig. 8).

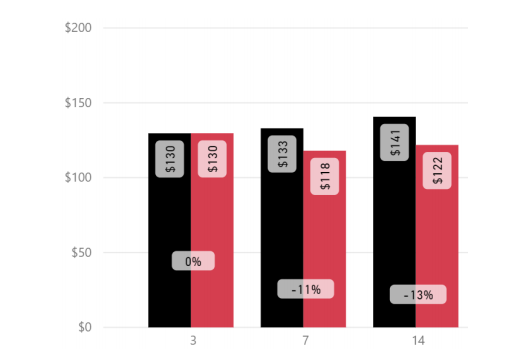

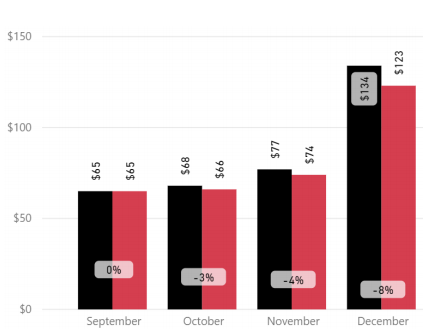

The average rate for 3-day duration was flat, while the average rate for longer 7-day and 14-day durations were lower by -11% and -13% respectively (Fig. 9).

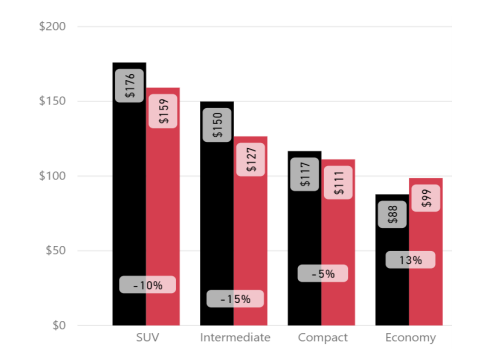

The average rate for SUVs in Christchurch was down -10%, with all other categories showed average rates of between +13% and -15% (Fig. 10).

Fig. 8

Fig. 9

Fig. 10

Overall Queenstown Airport had a YoY average rate increase of +5%.

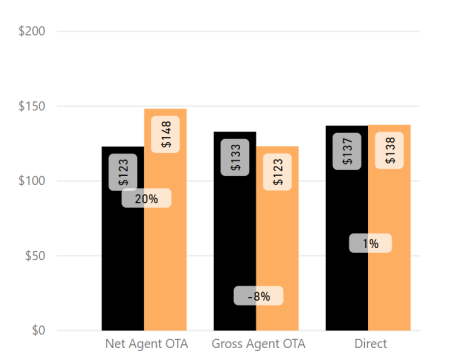

The Net Agent OTA sales channel average rate was +20%, while the Gross Agent OTA and the Direct sales channels showed decreases of -8% and +1% respectively (Fig. 11).

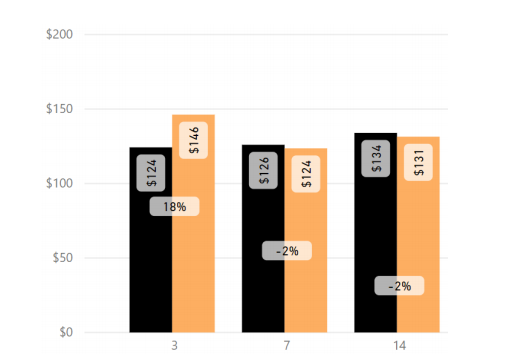

The average rate for a 3-day duration increased +18%, while the average rate for longer 7-day and 14-day durations were down -2% (Fig. 12).

The average rate for SUVs in Queenstown was up +13%, with all other categories showed average rates of between +2% and +11% (Fig. 13).

Fig. 11

Fig. 12

Fig. 13

Fig. 14

Fig. 15

Fig. 16

Fig. 17

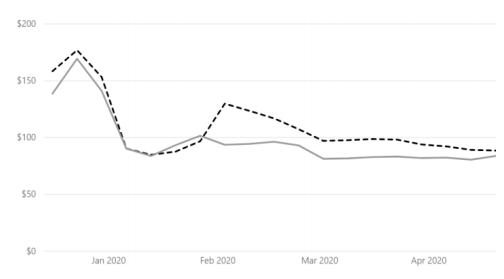

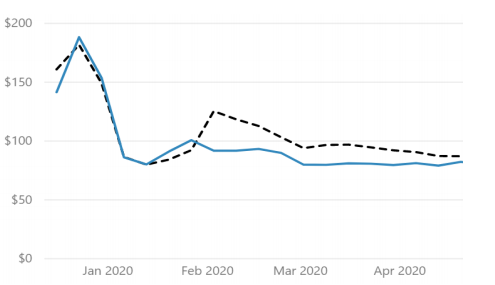

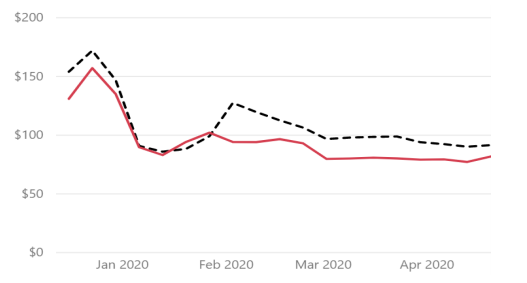

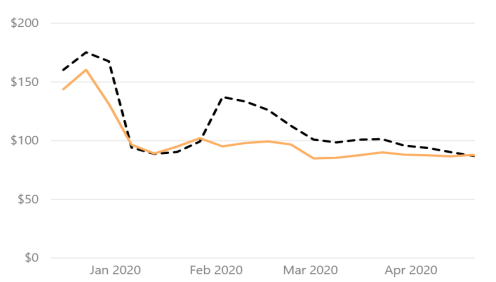

On the back of softer rates in December 2019, the average rate continues to be below last year for the first half of January 2020, then picks up slightly for the latter part of January 2020, and once again starts to trend lower from early February 2020 due in part to the seasonal timing of Chinese New Year (Fig.18). All regions follow a similar trend (Fig.19 to Fig.21).

Market Insider Tip:

Chinese New Year is a couple of weeks earlier in 2020 compared to 2019, and this will have a material impact on revenue during this period.

To allow for the potential shortfall in February revenue, focus will be on maximizing revenue as a result of all the seasonal holidays falling into what is effectively an extended long weekend during the latter part of January 2020. One way to do this is with targeted campaigns, such as the weekend promotions.

Fig. 18

Fig. 19

Fig. 20

Fig. 21

Market Insider Tip:

The earlier Chinese New Year holiday falls into Auckland Anniversary weekend and the tail of the School Holidays and can extend to Waitangi Day.

Effectively the Chinese New Year holiday period is from 20th January to 9th February 2020, with a bulk of the revenue generation being in late January 2020.

Make sure your fleet mix is correct: traditionally SUVs and 4x4s are very popular in Christchurch.

Fig. 26

Fig. 27

Fig. 28

Fig. 29

Methodology:

Terminology:

Disclaimer:

This report is intended as a guide only.

MarginFuel European Office

Nieder Kirchweg 9

65934 Frankfurt am Main

Germany

MarginFuel Americas Office

281 Belleview Blvd Unit 101

Belleair, Clearwater

Florida 33756

USA